- Home

- Pre-Foreclosure Properties

- Sellers

- Approved Agents

- We are here to help you!

- Can a Real Estate Auction Company Extend my Auction Date?

- A new law in California came into effect offering critical protections to homeowners facing foreclosure

- Understanding the Subject to Contract

- The Foreclosure Process – Step By Step

- KeepYourKeys.org Offers Help to People Facing Foreclosure

- Let us Postpone Your Foreclosure Date

- Learn about pre-foreclosure

- Can I Sell My House in Default in California?

- Can I Sell My House Before Foreclosure?

- California Foreclosure Laws and Statutes

- Facing a Foreclosure in California? Here’s What Will Happen

- Foreclosure Process Questionnaire

- What to Do When You Can’t Afford Payments and how to Avoid Foreclosure

- California Foreclosure and Mortgage Help

- StopForeclosureHelp.com

- Contact

The Foreclosure Process – Step By Step

The foreclosure process, a term often used in today’s economy is, simply when a mortgage holder or a money lender decides to take legal action over the borrower, when the contract terms of the lending process are not met.

Normally, in such agreements, the law agrees that when the borrower is failing with the payments, the lender is liable to take possession of the property, to avoid being at a loss with the deal and recoup the investment.

There are several legal procedures that are taken along this process but it all starts out with the signing of a promissory note, which completely gives the lender total security under the mortgage put upon a house or property. When the borrower fails to meet the stipulated payment terms, the respective loan ceases to generate profit for the lender or Mortgage Company. Since the cash flow is not running thru that mortgage, the mortgage has entered in a stage where it is considered a non performing process.

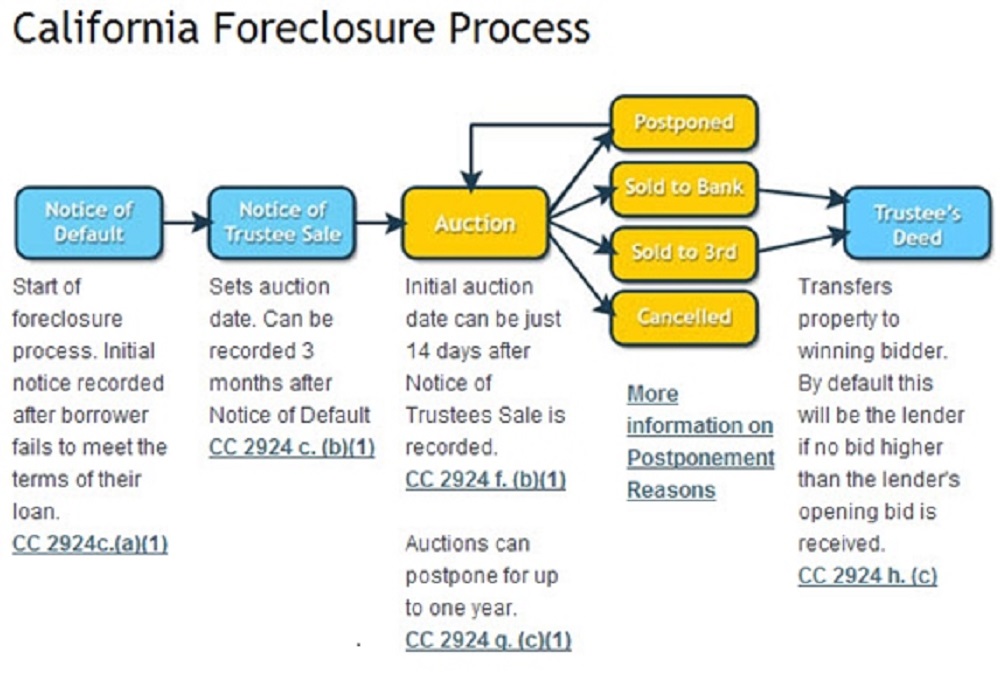

At that point, the mortgage company can start a foreclosure process which will follow these three steps:

Stage One – Pre-Foreclosure: At this stage, the foreclosure process per se has not been initiated yet. We are at a stage where the borrower fails a payment and the law now considers the individual as being at legal fault towards the lender. After two weeks of being late, the borrower is now considered “officially late” and a new process is initiated. At this stage, the lender company often calls the borrower or sends a late payment note and tries to understand whey he is late.

If the borrower continues to be at fault towards the loaner for 45 days to 60 days, the mortgage company can send a “demand” notification, using registered mail and now the borrower is then, officially informed that he is breaking the contract and the term foreclosure is, for the first time, mentioned in the lender’s communication. The borrower will be given information on how to stop the foreclosure process and is encouraged to communicate with the lender.

Around the 90th day, the mortgage company’s lawyers have started to study the process and taking legal action, redirecting the lender’s claim to state court or contacting the trustee.

There are two types of foreclosure processes that can be initiated. Judicial processes and non-judicial foreclosure processes.

In the first, there is a clear intention from the lender to take legal action on the borrower at fault. The lender will then be required to show evidence to the court of law. The judicial foreclosure method is often used in states where the lien theory is predominant. In those cases, the lien property can be used to compensate the lender, when the borrower is at fault.

The second type of foreclosure process is non-judicial: In the so called title theory states, this process includes the use of a deed, rather than a mortgage to secure the contracts. In the trust deed, a third party trustee is often assigned to receive the deed in trust and to help the lender sell the borrower’s property, if the borrower fails to meet the contract. Before the beginning of the actual foreclosure process, the borrower can always try to pay the debts and safe keep his home. If the borrower pays his debts, the lender can, at some points, not only terminate the official proceeds but also reinstate the loan.

Of Note: The State of California primarily uses the non-judicial process.

Stage Two – The Auction Sale: When you reach the auction phase, the foreclosure process per se, has already begun. The pre phase is officially shut down and now begins the process of auctioning the borrower’s property and try to get back the money from the loan. The auction process takes place at the courthouse and the highest bidder takes the house. The homeowners’ rights to the interest in the property are terminated by the auction sale, except in the so called redemption periods.

Stage Three – The redemption period: How long this period lasts is dictated by state law. The new happy owner has now full access to ownership rights but his owning of the property is only technical because during a period of time, which is defined by law, the late borrowers can still have the last chance to redeem themselves on the late actions and try to gather the necessary amount of money to buy the house back from the new owners. In this Redemption period, the new owner is legally obliged to sell the house, if the late owner can reinstate the missing payments to the lender.

Not all states have redemption periods and it actually depends on weather the states defends the lien or the title theory. In most pro-lien states the redemption period is instituted and in most title states, the redemption periods are not mandatory but are also an option. They range in duration from several days to over a year.

Of Note: California foreclosures are non-judicial, which means there is no redemption period after the sale, so the homeowner generally cannot redeem the property once it is sold at foreclosure.

Stage Four – The final phase: It’s called the Post- Foreclosure and at this stage, the property is irrevocably in the total ownership of the new owner or the mortgage institution, if it was not sold yet.

The redemption period has come to an end and the borrower was not successful in paying the total debt, so the property ownership was transferred to the lender. This property, is not causing any interest to the firm and is now part of the lot, and called a REO (real estate owned).

Those properties are obviously, most often listed on auction sales or with any real estate agent. It’s not uncommon to go to a real estate agent and find bank owned homes listed on sale; the purchase process is equal to buying a ‘regular’ home. The process is simple and can be done with the help of your real estate agent.

Of Note: The final phases of a foreclosure in California are the sale, redemption period, and eviction.

Final Phase – If the borrower doesn’t redeem the property during the redemption period, the new owner can begin the eviction process. The new owner must serve the borrower with an eviction notice, and then file an Unlawful Detainer lawsuit in court. If the borrower loses the lawsuit, the Sheriff will post a 5-day eviction notice on their door. If the borrower doesn’t move out within five days, the Sheriff will force them to move out.

Unlawful Detainer – Notice to quit

The new owner must serve the tenant a written notice to quit, which gives the tenant three days to leave the property. The three-day period does not include weekends or holidays.

- Unlawful detainer lawsuit

If the tenant does not leave after the notice to quit expires, the new owner can file an unlawful detainer lawsuit to evict them.

Here are some other things to know about unlawful detainer lawsuits in California:

- The new owner must also comply with statutory foreclosure procedures.

- Tenants in foreclosed properties are protected by California law, which requires the new owner to give them 90 days’ notice before eviction proceedings. This protection applies even if the property changes hands multiple times.

- The eviction process includes a mandatory settlement conference where the parties can try to resolve the lawsuit without going to trial.

- If the landlord wins the lawsuit, they can ask the judge for papers to have the sheriff evict the tenant.

- Landlords cannot turn off utilities, lock tenants out, or throw out their belongings to force them to leave. Doing so may result in the landlord having to pay the tenant a penalty.

The foreclosure process in California can take several months, typically around 120 days, but it can take as long as 200 days or more.

Do You Need Help with Foreclosure or Trustee Sales?

We can help you with both sides of this. Whether you are looking at California foreclosure laws from the homeowner’s perspective and trying to retain ownership – or looking into first-time buying at trustee sale. California is unfortunately the 10th most foreclosed state in America, so there’s plenty of choice.

Our goal is to help you try to save your home from foreclosure and bankruptcy!

Terry Jenkins – Realtor / Auctioneer

Century 21® Select Real Estate – DRE# 02096855

CREA – Certified Real Estate Auctioneer®

Jenkins Real Estate Auctions LLC – Formed In CALIFORNIA

Entity No. 202358616912

Registered: State of California Secretary of State

Surety Bond Auctioneer/Auction Company / Bond Number 387770D

Professional Affiliations

CREA® Certified Real Estate Auctioneer

2022 Masters Club Member

C.A.R. Luxury Property Marketing Certified

Luxury Home Certified

REO Agent – Distressed Property Expert

Member of:

National Association of Realtors,

California Association of Realtors,

Placer County Association of Realtors,

Disclaimer: This material is provided for information purposes only and is not to be construed as financial, investment or tax advice. Readers are strongly advised to consult with their professional advisors regarding the information herein.

- Home

- Pre-Foreclosure Properties

- Sellers

- Approved Agents

- We are here to help you!

- Can a Real Estate Auction Company Extend my Auction Date?

- A new law in California came into effect offering critical protections to homeowners facing foreclosure

- Understanding the Subject to Contract

- The Foreclosure Process – Step By Step

- KeepYourKeys.org Offers Help to People Facing Foreclosure

- Let us Postpone Your Foreclosure Date

- Learn about pre-foreclosure

- Can I Sell My House in Default in California?

- Can I Sell My House Before Foreclosure?

- California Foreclosure Laws and Statutes

- Facing a Foreclosure in California? Here’s What Will Happen

- Foreclosure Process Questionnaire

- What to Do When You Can’t Afford Payments and how to Avoid Foreclosure

- California Foreclosure and Mortgage Help

- StopForeclosureHelp.com

- Contact

The information and notices contained on this website are intended as general research and information and are expressly not intended, and should not be regarded, as financial or legal advice. We attempt to ensure that the material contained on the web-site is accurate and complete at the date first published, however you should recognize that information contained on this web-site may become out of date over time. Readers who have particular real estate financing or foreclosure challenge, or who believe they require legal counsel, should seek the advice from their personal attorney. By submitting this contact request, you are consenting to be contacted by; real estate agents, attorneys, mortgage relief advocates or loan modification services in and out of our network by telephone or email, even if you have previously listed yourself on any state or federal Do-Not-Call List. Please note that our company may or may not receive compensation for that introduction.

IMPORTANT NOTICE: Pre-ForeclosureHelp.com is not a mortgage relief service and only offer information for review, mortgage lenders, a lawyer referral service or a law firm and the information contained herein is not legal advice. Using Pre-ForeclosureHelp.com does not create an attorney-client relationship between any attorneys in our network. Pre-ForeclosureHelp.com is not a government sponsored website or program and is not approved by your lender. To access information on government sponsored assistance, please visit https://www.hud.gov/. This website is a state or local government website. Pre-ForeclosureHelp.com matches consumers with: real estate agents, lenders, attorneys, advocates or services in our network that may offer foreclosure help, mortgage relief or loan modification services. No particular result is guaranteed by engaging with partners in our network and lenders may not agree to change a consumer’s loan by using their services. There is no guarantee that you may qualify for a loan modification or prevent the foreclosure process. Pre-ForeclosureHelp.com does not charge any up front fees.