- Home

- Pre-Foreclosure Properties

- Sellers

- Approved Agents

- We are here to help you!

- Can a Real Estate Auction Company Extend my Auction Date?

- A new law in California came into effect offering critical protections to homeowners facing foreclosure

- Understanding the Subject to Contract

- The Foreclosure Process – Step By Step

- KeepYourKeys.org Offers Help to People Facing Foreclosure

- Let us Postpone Your Foreclosure Date

- Learn about pre-foreclosure

- Can I Sell My House in Default in California?

- Can I Sell My House Before Foreclosure?

- California Foreclosure Laws and Statutes

- Facing a Foreclosure in California? Here’s What Will Happen

- Foreclosure Process Questionnaire

- What to Do When You Can’t Afford Payments and how to Avoid Foreclosure

- California Foreclosure and Mortgage Help

- StopForeclosureHelp.com

- Contact

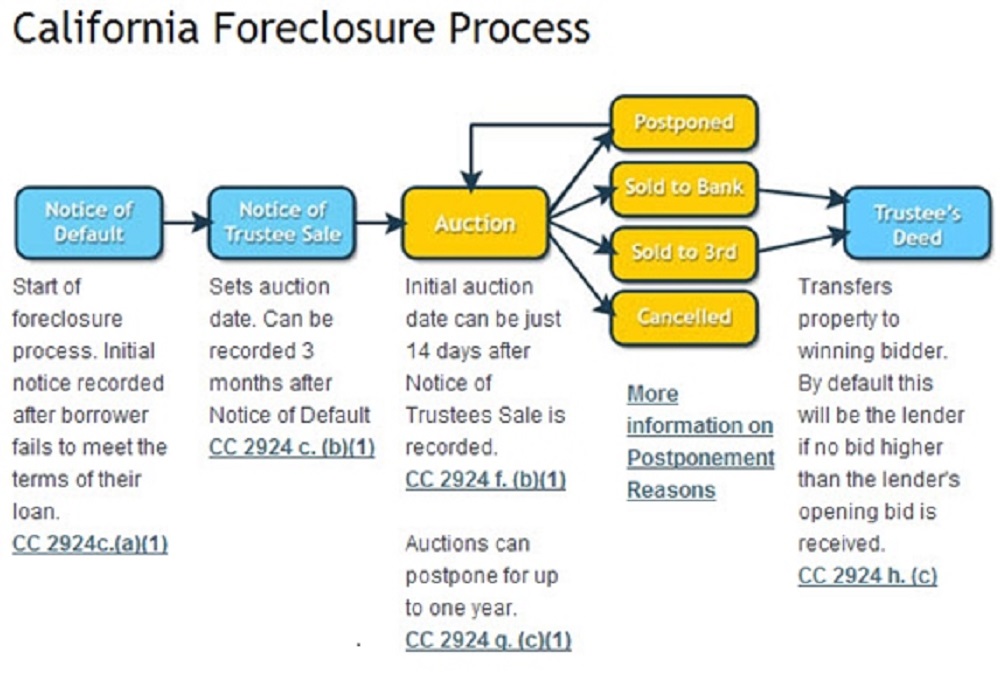

What is a: Notice of Default

Start of the foreclosure process. Initial notice recorded after the borrower fails to meet the terms of their loan. 90 days delinquent.

Notice of Trustee Sale

Sets auction date. Can be recorded 3 months after Notice of Default

Auction

Initial auction date can be just 20 days after the Notice of Trustees Sale is recorded.

Auctions can postpone for up to one year.

Postponed/sold to Bank/sold to 3rd Party/cancelled

In California, foreclosure sales can be postponed for up to one year per CA Civil Code CC 2924 g. (c) (1)

A real estate property auction company can work with you to auction your property and potentially postpone a foreclosure by selling it quickly through an auction, giving you time to negotiate with your lender and potentially avoid foreclosure altogether; however, it’s crucial to consult with a legal professional to understand your specific situation and the best course of action.

A postponement can give the homeowner more time to: Restore their budget, become current on their payments, and develop a legal strategy to fight the foreclosure.

The postponement reasons are outlined in, but the following names are commonly used at the foreclosure auctions.

1. Mutual Agreement. The most common postponement reason, it simply indicates that the homeowner and the lender have agreed to postpone the sale. This may be the result of a simple call by the homeowner requesting a little more time, or a more formal agreement like forbearance. Many homeowners do not realize when they enter a forbearance agreement that the foreclosure process continues, and if they miss an agreed-upon payment, the property can be sold on the next scheduled sale date with no further notice.

2. Bankruptcy. When a homeowner files for bankruptcy protection, it puts an automatic stay on all debt collection actions, including foreclosure. Note that bankruptcy does not stop foreclosure, as many believe. Instead, it simply delays the sale of the property until the homeowner resolves the debt, or in many cases, the lender gets approval from the bankruptcy court to continue the sale – an order granting motion for relief from stay. The bottom line is that a home is a secured debt, and the lender has the right to take the security (the home) if the homeowner lacks the ability to pay the debt as agreed. Bankruptcy is only an effective tool against foreclosure if the homeowner will have sufficient income to pay their home loan and makeup past due amounts once the bankruptcy plan is completed.

3. Beneficiary’s Request. A simple decision by the lender (beneficiary) to postpone the sale. It could be for any reason, including that they simply aren’t prepared to take the property for sale, or because they have reason to believe they are about to be paid (a closed escrow for which they have not yet received payment, for example).

4. Trustee’s Discretion. A simple decision by the trustee to postpone the sale. The most typical reason is that they are unable to reach the lender for sale instructions.

5. Operation of Law. Fairly rare, but used when a court orders the postponement of the sale. The most likely reasons for a court to make such an order would be in cases where there is a plausible allegation of fraud against the lender, or there are questions of material fact around the right of the lender to foreclose.

No matter what the postponement reason, a new notice of trustee sale must be posted and filed if the sale is postponed for more than 365 days.

An Overview

The following information gives you an idea what happens when a foreclosure takes place. You have various options open to you before you proceed with the process. Therefore, you can negotiate a deal and follow a plan that will assist you in keeping your home. After reviewing the options, you may still choose to go through foreclosure. The choice you make depends on your debt load and lifestyle.

Why Foreclosure Occurs

Foreclosure normally follows unemployment or unexpected bills. If an adjustable rate mortgage is re-established at a higher rate, your payments can easily become too difficult to make. Once you start falling behind, you have several months before the lender begins foreclosure proceedings.

Foreclosure is a long and tedious process – good news for the homeowner who is facing this event. That means you have time to plan, assess, and negotiate. Once you start having trouble making your house payments, you need to act. For example, if you have missed a few payments, you may be able to include the missed payments at the end of the loan or catch up over a specific time span. Even if your lender is not that flexible, you may be able to negotiate a plan.

Once you know that you are in trouble, never wait for the lender to contact you. Contact him or her instead. By referring to this guide, you can find out how to maintain a good rapport with your lending or mortgage company.

Do Not Panic

Because you do have some time to work out a plan, do not panic. Doing so could lead you to someone who is using foreclosure rescue to scam you. It is better to go through the foreclosure process instead of falling prey to one of these scams.

The foreclosure process in California is complex. Therefore, going through the steps can become confusing. However, if you understand the procedure timeline, you can more easily review the situation and the various options. The steps below show what happens during the foreclosure proceedings.

The Technical Details

In California, foreclosures are normally non-judicial. However, in some instances, homeowners go through judicial foreclosures. Non-judicial foreclosures are normally held because homeowners avoid going to court and the proceedings go faster. If you have taken out a mortgage on your home, you generally will need to go through a judicial foreclosure.

On the other hand, if you secured the home with a deed of trust, you will normally go through a non-judicial foreclosure. Deeds of trusts are regularly used to secure properties in California. That is another reason why non-judicial foreclosures are popular.

Foreclosure Proceedings

Two types of foreclosures are defined in the U.S. These two types include a judicial foreclosure and a non-judicial foreclosure, which is also known as a Power of Sale.

Taking a Closer Look at Judicial Foreclosures

Every state in the U.S. permits judicial foreclosures. A judicial foreclosure is performed through a state court via a lawsuit. As a result, this type of foreclosure can be more expensive and take longer than the non-judicial kind. In fact, some judicial foreclosures may take years to settle.

How a Judicial Foreclosure Begins

A judicial foreclosure starts when a lender files a lawsuit against the borrower in court. The borrower is served with a Summons and Complaint. The paperwork describes the type of loan and the default. If the borrower believes the foreclosure action is invalid, he or she can oppose the action. To do this, the borrower files an answer to the complaint.

What Happens If You Do Not Respond

If you do not respond in any way, shape, or form to a judicial summons, the lender wins the case and a foreclosure sale will be scheduled. If you object to the foreclosure, however, you can explain your reasons for objecting to the action. The judge, in turn, will decide whether the home can be sold. Borrowers should hire an attorney if they become embroiled in this type of legal action.

Responding to a Power of Sale – Non-judicial Foreclosures

California is both a Judicial and a Non-Judicial State but normally Non-Judicial

As the name suggests, non-judicial foreclosures do not go through a court process. As a result, they proceed more quickly and with less expense. Most of these processes only last a few months after the NOD (notice of default) has been issued.

Receiving Notice

In a non-judicial foreclosure, the borrower receives notice of default and is informed when a sale is scheduled. The notice is recorded in the real estate records of the county, posted on the property, or mailed to the home owner. A Notice of Sale is published in the area newspaper to alert the public. This is published 90 days after the NOD or Notice of Default has been recorded.

The auction date depends on certain factors. Technically, the auction can be scheduled 20 days after the Notice of Sale is posted. However, the auction can be delayed as long as a year if you wish to try to save your house.

You can postpone the auction with the help of an attorney, cancel the sale by initiating a deed in lieu of foreclosure or arranging a short sale, or sell the home to the bank. If the house is returned to the lender, you have the option of buying the house back.

Looking At Foreclosure in Three Basic Steps

1) Pre-Foreclosure

This part of the foreclosure process begins with a Notice of Intent to Foreclose or Notice of Default, which is referred to as a breach letter or NOI. This letter is delivered from the lender and officially begins the phase known as pre-foreclosure. The NOI is basically a notice in writing that comes from the lender, outlining what a borrower needs to pay and when the payment is due to avoid foreclosure.

Home Retention Programs

At this point, the borrower can elect to avoid foreclosure by taking advantage of home retention programs in the form of long-term loan modifications, forbearance plans, or a short-term repayment option. Short sales can be utilized where the sale of the home is less than the amount owed, or a transfer of title to the lender can be performed, which is called a deed-in-lieu foreclosure.

Never Ignore a Notice of Default (NOD)

You should never ignore an NOD if you do not want the foreclosure process to continue. While you may not be able to save your property, you may be able to do something to keep a foreclosure from being recorded on your credit report.

Stay in Touch with Your Lender

Always let a lender know early if you have any difficulty making payments. A lender’s ability to help a homeowner diminishes after each payment that is missed. Also, remain in your home. Abandoning a property may make it more difficult for you to qualify for any extensions or financial programs meant to help homeowners who fall behind in their payments.

Do not Fall for Scams

Always beware of scams. Scam artists like to prey on homeowners who are financially struggling. Never talk to anyone who charges a fee for modifying a home loan or provides counseling. Also, be wary of anyone who wants you to sign paperwork quickly or says that they can save your house if you transfer your home’s deed over to them.

2) Loan Acceleration

If you do not repay the amount in the arrears that is referenced in an NOI, the loan balance may be accelerated. The NOI only requires that a homeowner pay the payments that are past due along with the interests, costs, fees, and escrow amount that is needed to bring the financing up to date.

Asking for the Full Balance Now

If you do not bring the amount current within the stipulated time, again, the lender has the right to accelerate the balance on the loan. This means he or she can state that the whole balance on the financing is due and payable now. In other words, the homeowner must pay off the entire debt. If the loan is accelerated the lender can easily move on to foreclosure.

3) The Trustee’s Sale for Foreclosure Auction

As a final step in foreclosure, the home is placed up for sale at an auction open to the public. The homeowner, at this point, receives a notice that states the date, location, and time of the sale. The Notice of Sale and auction date are also recorded publically. The recording is made in the local newspapers, on county land records, or may be posted on the door of a home up for auction. Notices by mail are also sent.

The Bidding Process

The bidding begins at the auction at a dollar amount that has be established by the lender. Usually, this amount is based on a home’s value or the amount of the obligation. Once the beginning bid is announced, the attendees at the auction may offer bids that are higher until the property is officially sold.

When the Property Becomes Real-estate Owned (REO)

If no bidders participate in the sale, other than the bank or lender, the property’s title will revert to the lender. When this happens, the property is categorized as an REO (real-estate owned) property. After a period, REO properties may be sold by lenders so their losses can be recouped.

The Final Steps after Foreclosure

Once the foreclosure sale has ended, a foreclosure deed is recorded that transfers a property’s title to a winning bidder or the lender. While the ownership has been transferred and the property is under new ownership, there are still certain processes that must be followed before the former homeowner is evicted.

Eviction

If you do not leave the home voluntarily after transfer of the title and there is no redemption period, a lender can seek the court’s assistance to evict you. In some instances, lenders are willing to discuss an arrangement called a cash for keys agreement. This helps a former owner with his or her moving costs. As part of this agreement, the former homeowner promises to leave the house in good condition

Trustee’s Deed

Transfers property to winning bidder.

By default, this will be the lender if no bid higher than the lender’s opening bid is received.

Pre-foreclosure

Properties are considered to be in Pre-foreclosure from the filing of the initial Notice of Default until the property is sold at auction. During this period, investors can purchase the home directly from the owner, Realtors can list the home, and Lenders can help them refinance.

Auction

Auction properties have had a Notice of Trustee Sale filed setting an auction date, and have not yet been sold or cancelled. Investors can purchase the home at auction; and Realtors® and Lenders can monitor their client’s properties, to ensure their listing and loan activities are completed before the auction.

Bank Owned

Bank-owned properties received no bid at auction, resulting in the bank taking ownership. These properties are commonly referred to by the banks as REO’s (Real Estate Owned). Investors can purchase these properties directly from the bank; and Realtors® can solicit the listing, since banks will almost certainly market the property for sale.

To learn more about our auction program text Jenkins Real Estate Auctions LLC at 916-588-0067 for more information today.

If you would like to discover the advantages of selling real estate via the auction method or have questions, please contact us for additional information and a representative from Jenkins Real Estate Auctions LLC will reach out to you.

CREA – Certified Real Estate Auctioneer®

Jenkins Real Estate Auctions LLC

Formed In California – Entity No. 202358616912

Registered: State of California Secretary of State

Surety Bond Auctioneer/Auction Company / Bond Number 387770D

Disclaimer: This material is provided for information purposes only and is not to be construed as financial, investment or tax advice. Readers are strongly advised to consult with their professional advisors regarding the information herein.

- Home

- Pre-Foreclosure Properties

- Sellers

- Approved Agents

- We are here to help you!

- Can a Real Estate Auction Company Extend my Auction Date?

- A new law in California came into effect offering critical protections to homeowners facing foreclosure

- Understanding the Subject to Contract

- The Foreclosure Process – Step By Step

- KeepYourKeys.org Offers Help to People Facing Foreclosure

- Let us Postpone Your Foreclosure Date

- Learn about pre-foreclosure

- Can I Sell My House in Default in California?

- Can I Sell My House Before Foreclosure?

- California Foreclosure Laws and Statutes

- Facing a Foreclosure in California? Here’s What Will Happen

- Foreclosure Process Questionnaire

- What to Do When You Can’t Afford Payments and how to Avoid Foreclosure

- California Foreclosure and Mortgage Help

- StopForeclosureHelp.com

- Contact

The information and notices contained on this website are intended as general research and information and are expressly not intended, and should not be regarded, as financial or legal advice. We attempt to ensure that the material contained on the web-site is accurate and complete at the date first published, however you should recognize that information contained on this web-site may become out of date over time. Readers who have particular real estate financing or foreclosure challenge, or who believe they require legal counsel, should seek the advice from their personal attorney. By submitting this contact request, you are consenting to be contacted by; real estate agents, attorneys, mortgage relief advocates or loan modification services in and out of our network by telephone or email, even if you have previously listed yourself on any state or federal Do-Not-Call List. Please note that our company may or may not receive compensation for that introduction.

IMPORTANT NOTICE: Pre-ForeclosureHelp.com is not a mortgage relief service and only offer information for review, mortgage lenders, a lawyer referral service or a law firm and the information contained herein is not legal advice. Using Pre-ForeclosureHelp.com does not create an attorney-client relationship between any attorneys in our network. Pre-ForeclosureHelp.com is not a government sponsored website or program and is not approved by your lender. To access information on government sponsored assistance, please visit https://www.hud.gov/. This website is a state or local government website. Pre-ForeclosureHelp.com matches consumers with: real estate agents, lenders, attorneys, advocates or services in our network that may offer foreclosure help, mortgage relief or loan modification services. No particular result is guaranteed by engaging with partners in our network and lenders may not agree to change a consumer’s loan by using their services. There is no guarantee that you may qualify for a loan modification or prevent the foreclosure process. Pre-ForeclosureHelp.com does not charge any up front fees.